Medicare Supplement Plan B: Costs and Benefits

April 11, 2019Medicare Supplement (Medigap) plans help cover out-of-pocket Medicare expenses including co-payments, coinsurance, and deductibles. Enrollment in these plans has increased every year, and more than 22% of Medicare enrollees take advantage of this type of supplemental coverage in 2019.

There are ten types of Medicare Supplement plans (A, B, C, D, F, G, K, L, M, N) and unlike Medicare Advantage plans, they provide the same basic benefits regardless of which carrier you enroll with.

Plus, most plans are “guaranteed life,” which means that as long as you pay your premium on time, you won’t be canceled from your plan if a new health condition develops.

Medicare Supplement plans are great for beneficiaries who would rather pay a small annual deductible for financial protection in the event of an unforeseen health expense.

What does Medicare Supplement Plan B Coverage Include?

Medicare Supplement Plan B is very similar to Medicare Supplement Plan A. The only difference is Plan B covers your Medicare Part A deductible. Plan B covers:

- Part A coinsurance and hospital costs

- Part B coinsurance and co-payments

- Bloodwork co-payments (up to 3 pints)

- Hospice coinsurance and co-payments

- Part A deductible

Medicare Plan B Cost

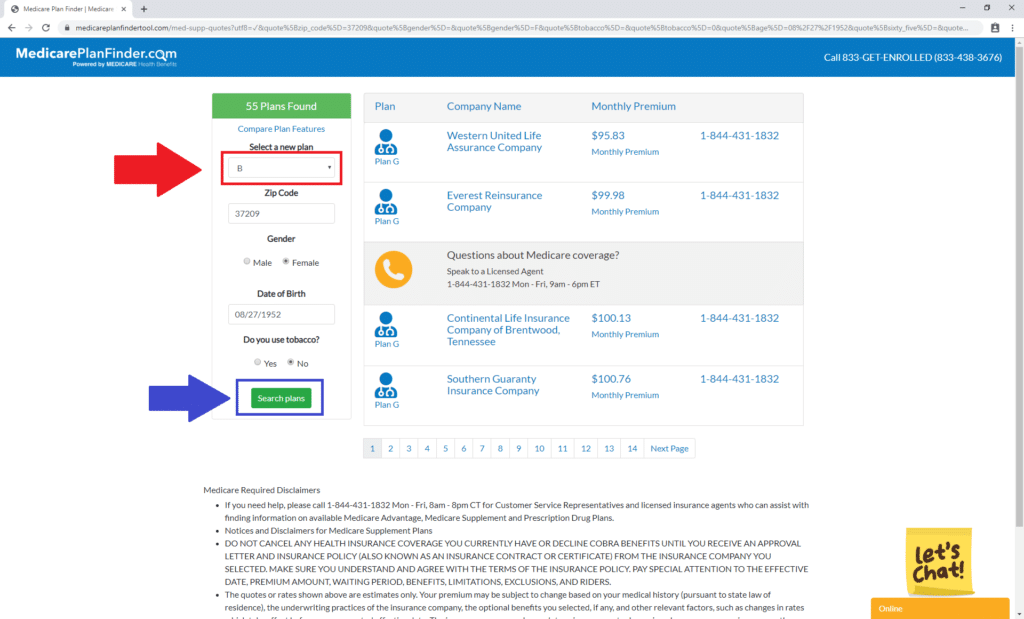

Even though the benefits are mostly the same per carrier, the costs of the plan will vary based on carrier, zip code, age, gender, and tobacco use. Some plans are as low as $80/ while some are as high as $140/month.

The fewer benefits a plan provides, the lower the monthly premium is. Since Plan B offers less coverage, it is typically one of the cheapest plans on the market.

Medicare Plan B Deductible

If you choose to enroll in a Plan B Medicare Supplement plan, you will be responsible for your Part B deductible, but your Part A deductible will be included in your plan. The 2019 Medicare Part B deductible is $185.

You will also be responsible for any skilled nursing facility care coinsurance, Part B excess charges, and emergency health costs while traveling. This is great if you rarely see unexpected health costs and would rather have lower monthly costs than high premiums for benefits you don’t use.

If you generally have high costs in the areas that Plan B does not cover, it may not be the best plan for you. Instead, you should consider the more comprehensive Plan G. Alternatively, if Plan B sounds great, but you would prefer a cheaper monthly payment, you should explore Plan A, which has fewer benefits but typically has the lowest costs.

Medicare Supplement Plan B vs. Medicare Part B

Medicare Plan B and Medicare Part B are two entirely different things but can be easily confused. Medicare Supplement Plan B is a Medigap plan and Medicare Part B works alongside Part A to form Original Medicare. It covers medically necessary doctor services and treatments as well as preventative services like yearly wellness visits. This includes lab tests, x-rays, emergency transportation, durable medical equipment, mental health, and partial hospitalization. If you want to enroll in Plan B (or any Medicare Supplement), you need to be enrolled in Part A and B first.

Medicare Supplement Plan B Options

There are several Medicare Supplement plans on the market, but availability will vary based on your location. As we’ve mentioned, plans generally offer the same coverage regardless of carrier, so why do some plans have better reviews? Companies with higher ratings generally offer plans with higher ratings. Customer service is another factor. Here is a list of the top Medigap carriers in 2019:

- AARP

- Aetna

- Amerigroup

- Cigna

- Humana

- Mutual of Omaha

- WellCare

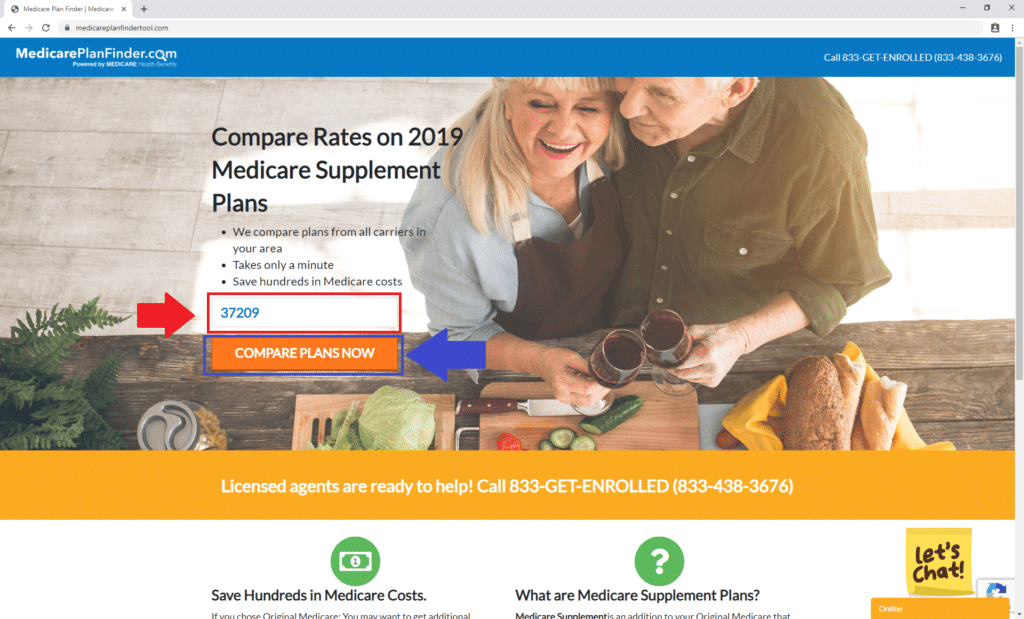

Use Our Medicare Supplement Plan Finder Tool to Find Plan B Options in Your Area

Our Medicare Supplement Plan Finder tool can help you find Plan B options in your area. Click here to get started. Enter your zip code in the box beside the red arrow. We chose 37209 because that’s the zip code for our corporate offices in Nashville, Tennessee.

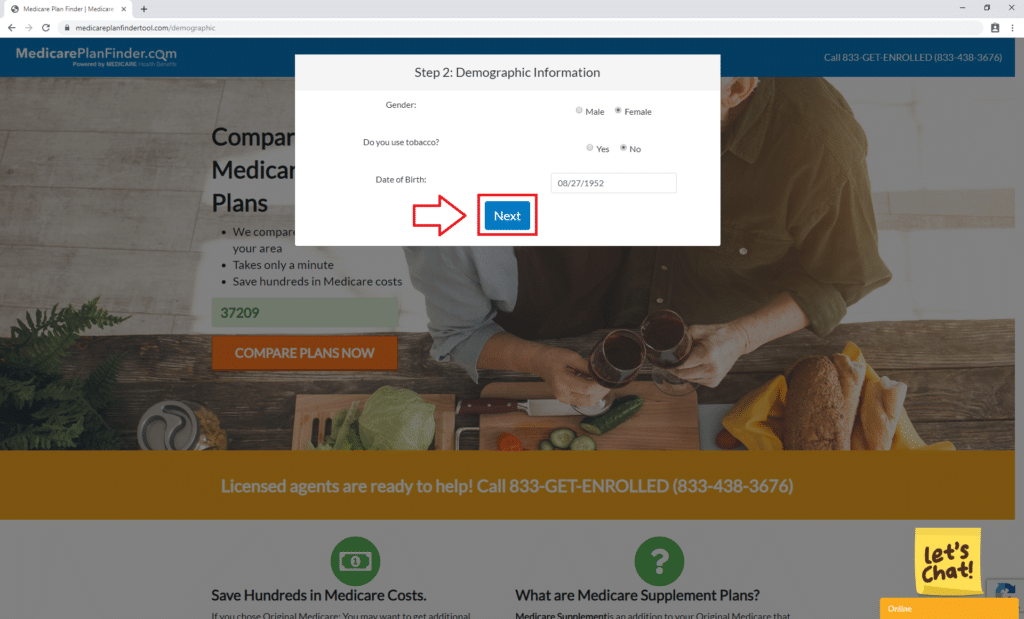

Next, choose the appropriate circles for your gender and tobacco use and enter your date of birth. Then click “Next.”

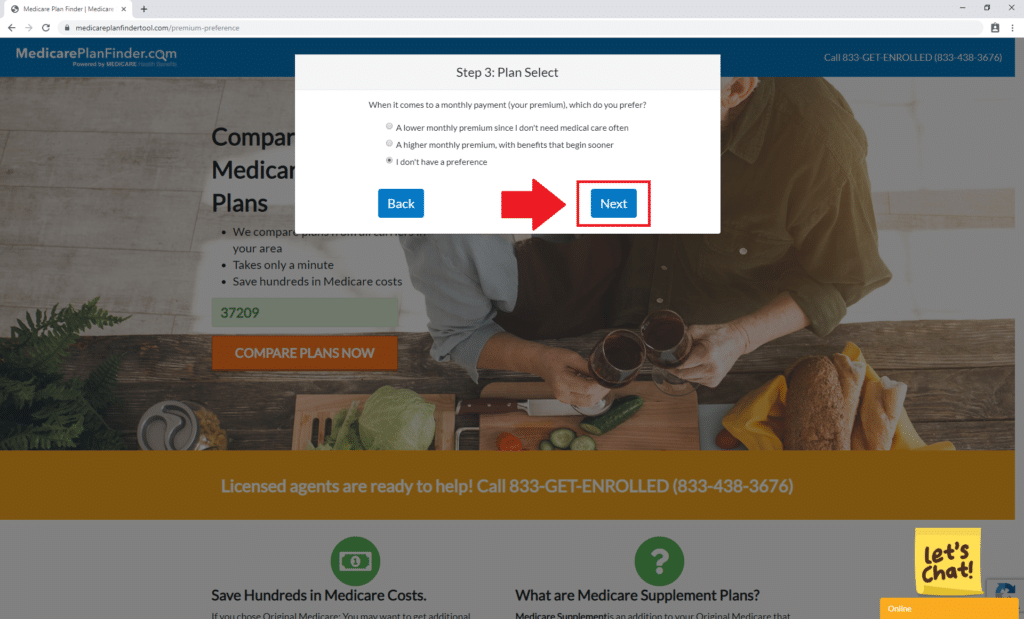

Then select your plan preference and click “Next.”

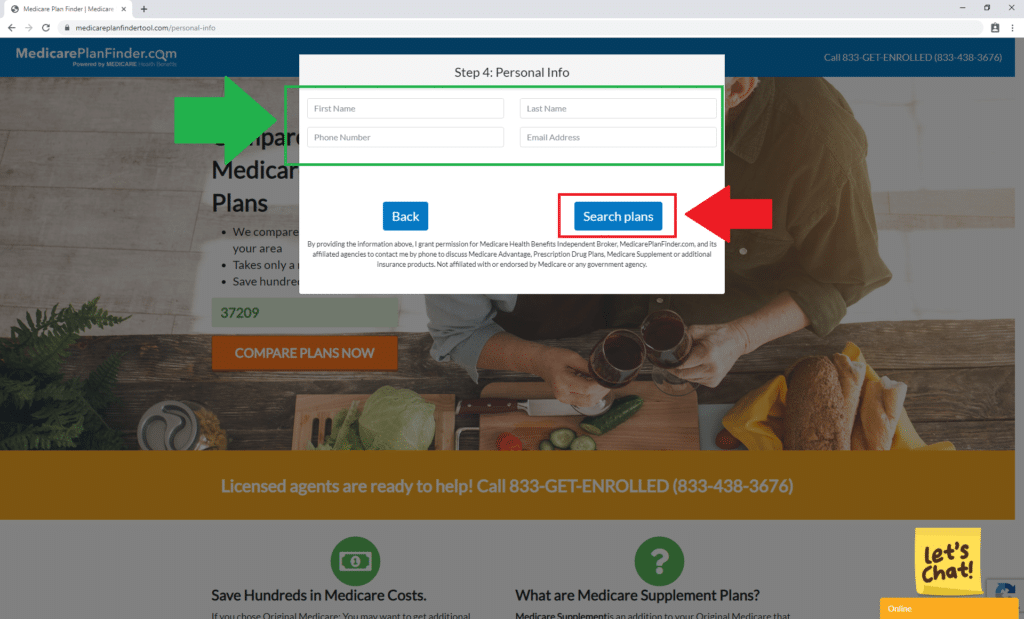

Next enter your personal information in the boxes beside the green arrow. Then click “Search plans” beside the red arrow.

The final step is viewing the Plan B options in your area. Select “B” from the drop-down menu beside the red arrow. Then click “Search plans” beside the blue arrow.

Medicare Plan B Enrollment

You can enroll in a Medicare Supplement plan during any time of the year, but carriers can deny you or charge you more for existing conditions. The best time to enroll is during your Initial Enrollment Period (IEP), which is the seven months around your 65th birthday. During this time, you can enroll in any plan that is available in your area regardless of any health issues you may have.

If saving money is important to you, a licensed agent can help you enroll in the cheapest plan available in your area. When you meet with one of our agents, there is never an obligation to enroll, and the appointment is entirely cost-free to you. Fill out this form or give us a call at 844-431-1832.