What Does Medicare Cost in 2019-2020?

October 15, 2019Surprise! Medicare is not free, as some may believe. Medicare beneficiaries can owe a variety of charges, including monthly premiums, yearly deductibles, and per-service copayments and coinsurance. What does that mean?

- Coinsurance = the percentage of a medical service that you owe

- Copayment = the fee you pay upon receiving a medical service or good

- Deductible = the amount you will owe before your coverage begins

- Premium = the amount you owe your insurance company or Medicare every month

Costs can change every year. We’ll keep this guide up-to-date so that you can know what to expect from your Medicare coverage this year.

How Much Does Medicare Cost at Age 65?

Medicare costs do not change as you age, but they can change if you wait too long to enroll. If you age into the Medicare program and sign up when you turn 65, it will cost $144.60 per month (2020) for Part B, unless you make too much money, in which case you’ll pay more. You’ll also play anywhere from $0-$458/month (2020) for Part A, depending on how much you’ve worked and contributed to Medicare taxes.

However, if you miss your Initial Enrollment Period (which begins three months before you turn 65 and ends three months after), you may be charged a late enrollment penalty fee. The penalty means that your premiums can be up to 10% higher than the base cost. Don’t wait to enroll!

What Does Medicare Cost Per Month in 2019-2020?

Your monthly Medicare costs will depend largely on what you qualify for and what you’ve signed up for.

Part A costs depend on how much you’ve worked. If you:

- Worked and paid Medicare taxes for over 39 quarters of your life? You won’t pay a Medicare Part A premium in 2019

- Worked and paid Medicare taxes for 30-39 quarters of your life? You’ll pay $252/month in 2020

- Worked and paid Medicare taxes for less than 30 quarters of your life? You’ll pay $458/month in 2020

Additionally, if you are eligible for retirement benefits from either Social Security or the Railroad Retirement Board, you will not owe a Part A premium.

The Part A inpatient hospital deductible has increased from $1,340 in 2019 to $1,408 in 2020.

Despite these premium costs, you may incur other costs, like deductibles, coinsurance, and copayments.

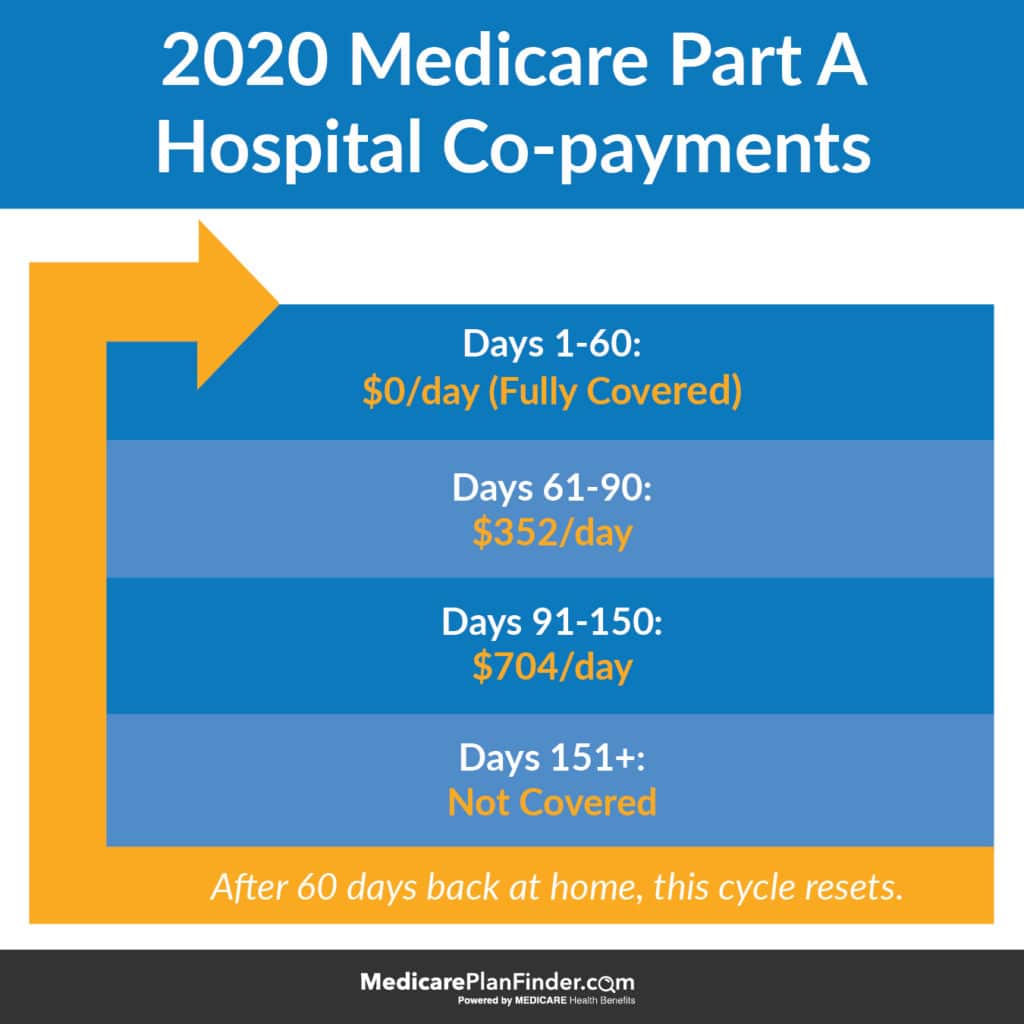

Hospital copayments depend on how many days you’ve been in the hospital. Your first 60 days are completely covered, then you’ll face copayments. Remember that you will also have to pay your deductible first ($1,408 in 2020).

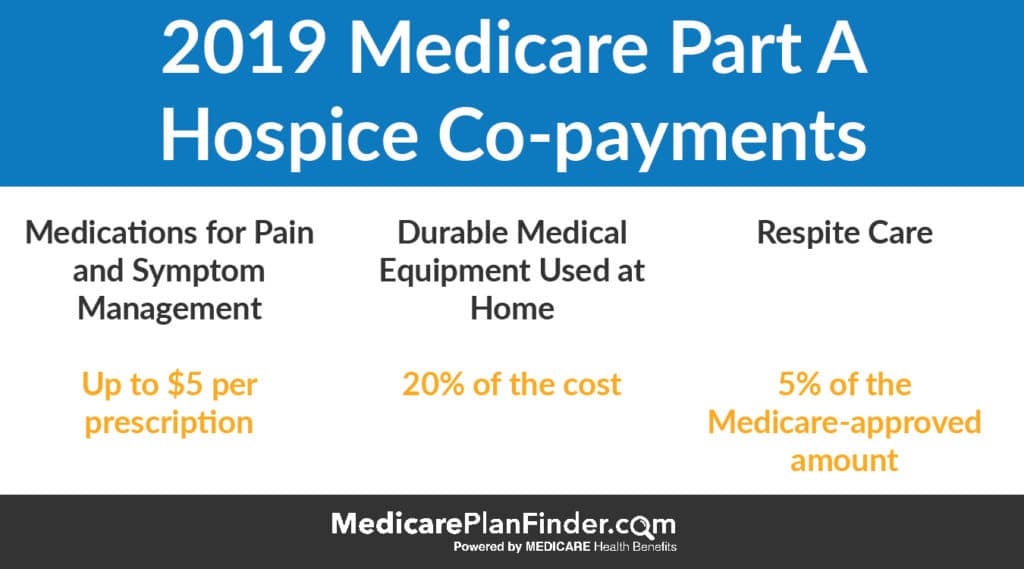

Hospice and nursing facilities are a bit different. The charts below explain some of the hospice and nursing facility costs that you may incur with Part A.

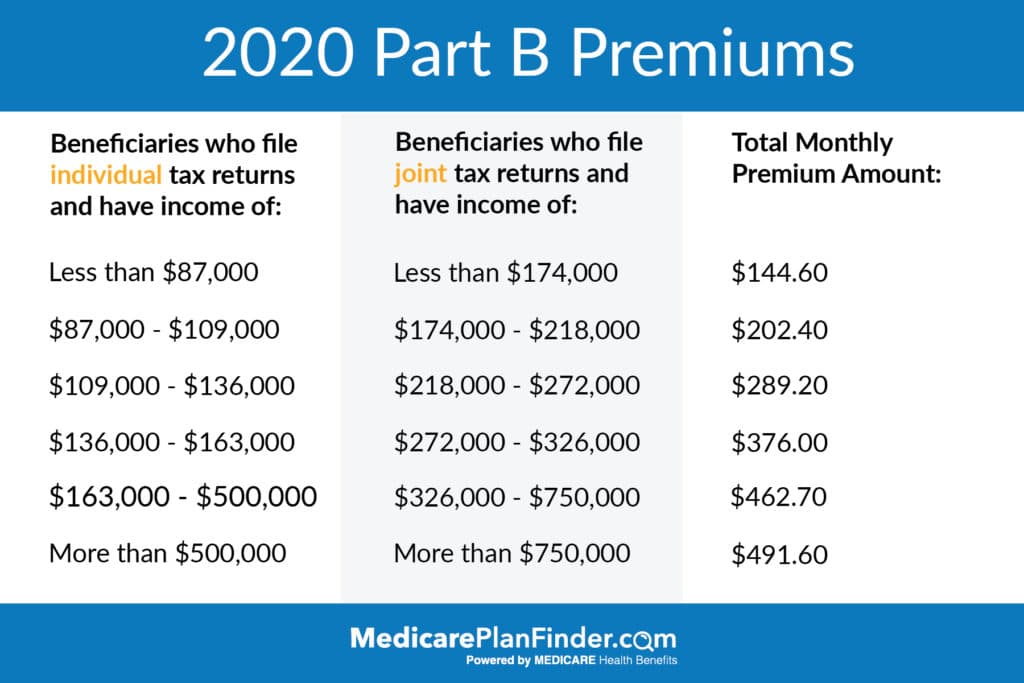

The standard monthly premium for Part B in 2020 is $144.60, but that can change based on your income.

An estimated 3.5% of beneficiaries (2 million) will pay less than this amount due to the Social Security “hold harmless” provision which prevents the increased premium to exceed the increase in Social Security benefits.

Additionally, if you make more than $87,000 a year, your monthly Part B premium will be adjusted based on your income. The income-based 2020 premiums for Part B are as follows:

Will Medicare Part B Premiums Increase in 2019?

Generally, Medicare premiums change once per year. The change has historically been incremental and has even been a decrease in certain years.

The standard Part B premium decreased in 1989 and 1996. Since 2000, it has been steadily increasing to the $144.60 that we have today.

2020 Medicare Part B Deductible Increase

The Medicare Part B deductible increased from $185 in 2019 to $198 in 2020, an increase of $12.

Medicare as a whole has been trying to discourage beneficiaries from taking advantage of small deductibles, as evidenced by the removal of Medigap Plan F from the market.

Who Has to Pay for Medicare Part B?

Everyone enrolled has to pay the Medicare Part B premium, but some people may qualify for savings. For example, if you are eligible for a Medicare Savings Program, you may be able to have your Medicare Part A and B premiums, deductibles, coinsurance, and copayments covered (depending on which program you qualify for).

How to Save on Medicare Premiums in 2020

You may be able to save on Medicare premiums by qualifying for Low-Income Subsidies (LIS), also known as Medicare Extra Help, or a Medicare Savings Program (MSP). LIS provides help with Medicare prescription costs, and MSPs provide help with a variety of other costs, such as premiums and deductibles.

There are four major MSPs:

- Qualified Medicare Beneficiary Program (QMB). Can help pay premiums for Part A and Part B, as well as copays, deductibles, and coinsurance. An individual may qualify in 2019 with an income up to $1,061 per month or $1,430 per month for a couple. If you qualify for QMB, you may also be eligible for Extra Help (LIS) paying for Part D prescription coverage.

- Specified Low Income Medicare Beneficiary Program (SLMB). Can help pay premiums for Part B. A single person may qualify in 2019 with an income up to $1,269 per month or $1,711 per month for a couple. If you qualify as a SLMB, you’re may be eligible for LIS paying for Part D prescription coverage.

- Qualified Individual Program (QI). Can help pay premiums for Part B. An individual may qualify in 2019 with an income of up to $1,426 per month or $1,923 per month for a couple. Note: QI enrollments are limited, and they’re granted on a first-come, first-served basis. If you qualify for QI, you may also qualify for Extra Help paying for Part D prescription coverage.

- Qualified Disabled and Working Individuals Program (QDWI). Can help to pay Part A premiums. This MSP is for disabled people who lost their premium-free Medicare Part A when they went back to work. The income limits for QDWI are $4,249 per month for an individual, and $5,722 for a couple in 2019. The asset limit is $4,000 for an individual and $6,000 for a couple.

In 2019, people with LIS did not pay more than $3.40 for generic drugs and $8.50 for brand-name drugs!

To qualify for LIS, you must have a monthly income of less than $1,405 for an individual or less than $1902 for a couple in 2019. You must also

- Have Original Medicare (Part A and Part B) coverage

- Have prescription drug coverage (either a Medicare Part D plan or a Medicare Advantage plan with prescription drug benefits)

- Have American citizenship

- Not have savings, investments, and real estate valuing more than $28,150 if you are married or $14,100 if you are single

Medicare Advantage and Medicare Supplement 2019–2020

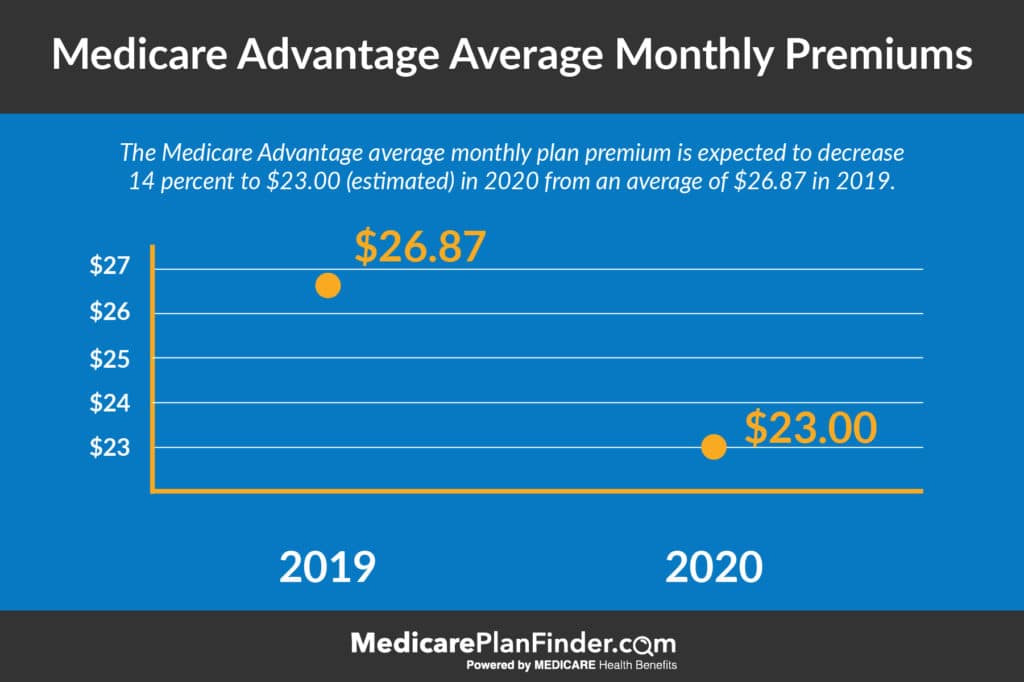

In 2020, Medicare Advantage premiums have decreased on average.

What does this mean for you? If your premium went up and you need a better option, the time is now! The annual enrollment period is October 15 through December 7. During this time you can switch or enroll in the best plan that fits your needs and budget. Our licensed agents can answer any questions you may have. If you’re interested in scheduling a no-cost, no-obligation appointment, fill out this form or call us at 844-431-1832.

This post was originally published on November 1, 2018, and was last updated on November 5, 2019.