A Guide to Medicare Coverage for Dementia

October 7, 2019A Guide to Medicare Coverage for Dementia

Dementia is a decline in mental capacity that becomes severe enough to hinder a person’s ability to function. According to the Alzheimer’s Association, one-third of Americans die with some form of dementia.

Medicare Parts A and B (Original Medicare) will cover everything that’s medically necessary for dementia patients, but many other services won’t be covered.

Original Medicare dementia care may be limited, but certain Medicare Advantage plans offer coverage for more services that can include unexpected offerings like meal delivery.

Medicare Coverage for Dementia Patients Clarified

An Original Medicare plan will cover services that your doctor deems medically necessary. Medicare Part A covers inpatient hospital care, and Medicare Part B covers outpatient care and medical expenses such as doctors’ appointment costs.

Original Medicare will pay for the first 100 days of care in a skilled nursing facility (there may be some associated fees), and some Medicare Advantage (Part C) plans may include long-term care coverage as well as skilled nursing care.

Private insurance companies offer Medicare Advantage plans, so they have the freedom to cover benefits Original Medicare doesn’t. Medicare Part D or certain Medicare Part C plans cover prescription drugs such as cholinesterase inhibitors that can temporarily improve symptoms of dementia.

Medicare Supplements

Medicare Supplements (Medigap) plans can help cover the expenses that Original Medicare does not. Unlike Medicare Advantage plans, Medigap plans do not cover medical expenses, but they cover financial items such as Part A and B coinsurance and copayments. Even though Medigap and Medicare Advantage are two different types of plans, you cannot enroll in both at the same time.

Does Medicare Pay for Dementia Testing?

Medicare Part B covers cognitive testing for dementia during annual wellness visits. A doctor may decide to perform the test for patients who are experiencing memory loss.

The test consists of about 30 questions like, “What year is this?” to assess the patient’s memory and awareness. The test can be used as a baseline evaluation for future wellness visits and can be a valuable tool for catching dementia early.

Medicare Testing for Alzheimer’s

Dementia is a symptom that can result from many different diseases. Alzheimer’s disease is just one cause of dementia. The risk of developing Alzheimer’s increases with age and with a family history of Alzheimer’s.

There is a correlation between genes called apolipoprotein E (APOE) and Alzheimer’s, but those genes do not necessarily cause the disease. Medicare will not cover genetic testing for APOE genes.

Dementia as a SEP-Qualifying Condition

Medicare eligibles with dementia also qualify for specific Medicare Advantage plans called Chronic Special Needs Plans (CSNPs). These health insurance plans involve coordination and communication between the patient’s entire medical team to help ensure the patient gets the best possible care.

The best way to sort through the thousands of plans available and find the right CSNP for you is enlisting the help of a qualified professional by contacting us here.

If you’re diagnosed with dementia and already enrolled in Medicare Parts A and B, you will qualify for the Special Enrollment Period (SEP). The SEP allows you to enroll in new Medicare coverage or make changes to your existing CSNP whenever you need to instead of having to wait for certain times of the year.

Eligibility for Medicare Coverage for Dementia

If you meet the eligibility requirements for Medicare Parts A & B, you will also be eligible for the dementia coverage provided by Medicare. You can obtain Medicare coverage for dementia services if you are:

- Age 65 or older

- Any age and have a disability, or end-stage renal disease (ESRD)

Dementia patients are also eligible for other specific Medicare plans once they are officially diagnosed with the condition, like special needs plans (SNPs) and chronic care management services (CCMR.)

Medicare can also cover home health care that dementia patients often need. In order to receive this coverage, it must be certified as necessary by a doctor. The patient must also be classified as homebound, meaning they have trouble leaving the house without help.

Does Medicare Cover Memory Care?

Memory care is a specific type of long-term care for Alzheimer’s patients or people with dementia. Original Medicare will cover occupational therapy but does not cover assisted living facilities. However, certain Medicare Part C plans may include coverage for Medicare dementia care services such as adult day care or help to get dressed or to bathe.

Medicare will not cover skilled nursing home stays for longer than 100 days, and even the most comprehensive Medigap plan won’t cover long-term care. However, Medicare will provide benefits for Alzheimer’s patients while they live at a nursing home.

What parts of Medicare cover dementia care?

Medicare dementia coverage is split between its component parts. Part A helps cover the cost of inpatient hospital stays, including the meals, nursing care, and medication that you need while you’re there. Meanwhile, Part B will cover the doctor’s services that you might receive during your stay in the hospital, such as testing or medical equipment.

Even more services can be covered by Part C, also called Medicare Advantage. In addition to everything covered by Parts A & B, these plans can also offer options for long-term and home care for dementia patients.

How Much Does Medicare pay for dementia care?

Each different part of Medicare will pay for its benefits in different ways. For example, Part A will cover the entire cost of your hospital or skilled nursing facility stay for the first 60 days. After this period, you will need to pay 20% coinsurance until day 90, when Part A will stop paying entirely.

Part B, on the other hand, will usually pay for 80% of all services that it covers. Medicare Supplement plans are often purchased to cover the remaining costs, and can also provide additional benefits to the patient.

Does Medicare cover long term care for dementia?

The long-term care insurance offered by Medicare depends on the nature of the service being provided to the patient. In many cases, the long-term care needed by dementia patients is classified as custodial care and won’t be covered by Medicare.

However, if your doctor prescribes a long-term care service as “medically necessary,” Medicare may help cover the costs. These exceptions can include services like hospice care, and part-time nursing care or occupational therapy provided in the home.

Does Medicare Pay for Home Health Care for Dementia Patients?

It is usually difficult to obtain coverage from Medicare for elderly care at home. However, it can completely cover some home health services that are deemed medically necessary by your doctor, including:

- Physical and occupational therapies

- Part-time skilled nursing care

- Medicare social services

Most nursing home care is also classified as custodial care by Medicare, meaning it will not be covered. Medicare will cover custodial home health care for dementia patients only if it’s a part of hospice care.

Medicare Advantage plans, however, can offer many different home health benefits for those who suffer with dementia. Examples include personal care assistance, homemaker services, and meal delivery.

Does Medicare Cover Assisted Living for Dementia?

Original Medicare will not cover any services that are deemed custodial or personal care, including any that aid in typical activities of daily living, such as:

- Eating

- Getting Dressed

- Bathing

- Using the restroom

This rule also applies to assisted living and memory care facilities which provide these services. But depending on your state and the facility of choice, Medicaid may be able to help cover the cost of long-term custodial care provided in assisted living facilities.

Medicare Dementia Hospice Criteria

In order for Medicare to cover hospice care, your doctor must first document that you have less than six months to live. You or your durable power of attorney must sign documents indicating that you agree to accept care for comfort and that you waive other Medicare benefits.

What dementia services does Medicare not cover?

In almost all cases, Medicare will not cover any non-medical care services, such as:

- Assisted-living or long-term care

- Custodial services provided in a facility or in the home

- Homemaker services

- Meal delivery

There are exceptions to these rules, but the service in question must be recommended as medically necessary by your doctor. Medicare Advantage plans may offer coverage for these and other personal care services not covered by Medicare.

How to Cover the Gaps with Medicare and Dementia

Paying for dementia care can be daunting, even for Medicare beneficiaries. Both Parts A & B have deductibles you have to meet, and Part B only pays for 80% of its covered services. At the end of the day, a patient and their family may be left wondering how to pay for Alzheimer’s care.

The answer may come in the form of Medicare Part C, also called Advantage plans, which can pay for many of the custodial care costs not covered by Original Medicare. Another option may be a Medicare SNP, or special needs plan, which are geared toward patients with certain chronic conditions such as dementia.

Early Signs and Symptoms of Dementia

Dementia can have a variety of symptoms depending on the cause, as well as if the patient is in the early stages or late stages of the disease. However, some common signs symptoms include:

Cognitive changes

- Loss of memory

- Difficulty finding the right words during conversation

- Getting lost while driving to and from familiar places

- Difficulty with logical reasoning or solving problems

- Difficulty with completing complex tasks

- Difficulty with planning and organizing day-to-day activities

- Difficulty with muscular coordination and motor functions

- Being confused or disoriented

Psychological changes

- Changes in personality

- Depression

- Anxiety

- Inappropriate or irrational behavior

- Paranoia

- Agitation

- Hallucinations

How to Find Memory Care

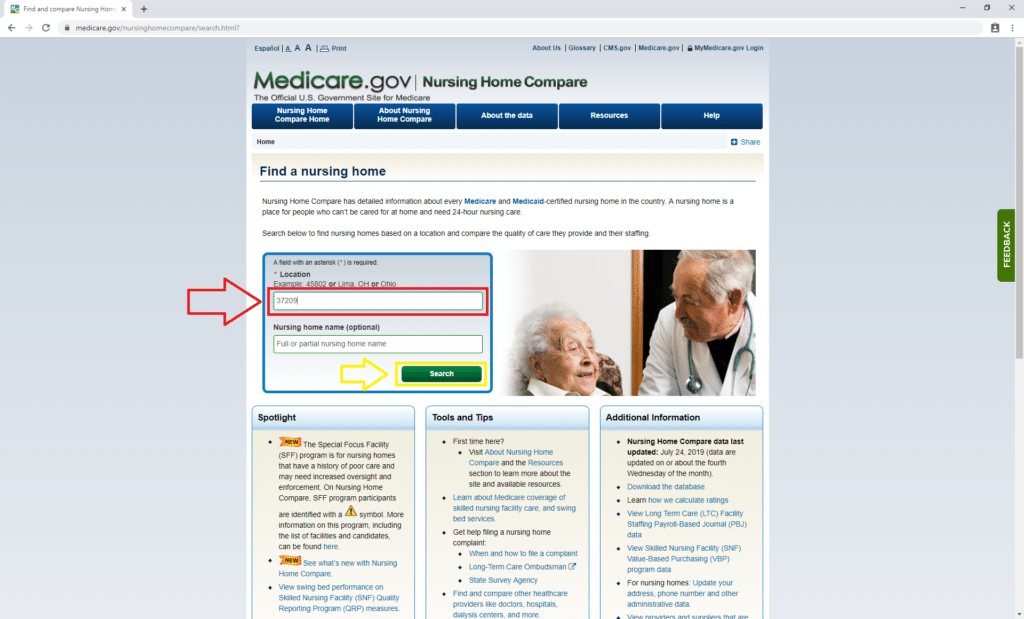

Medicare.gov has a tool to find nursing homes that accept Medicare for medical services. To get started, click here. Not all of these facilities have dedicated memory care teams, so you’ll need to contact them to verify their services.

Once you’re on the nursing home finder tool page, enter your zip code as shown below in red. We used 37209, which is our corporate headquarters’ zip code in Nashville, Tennessee. Then click “Search,” shown in yellow.

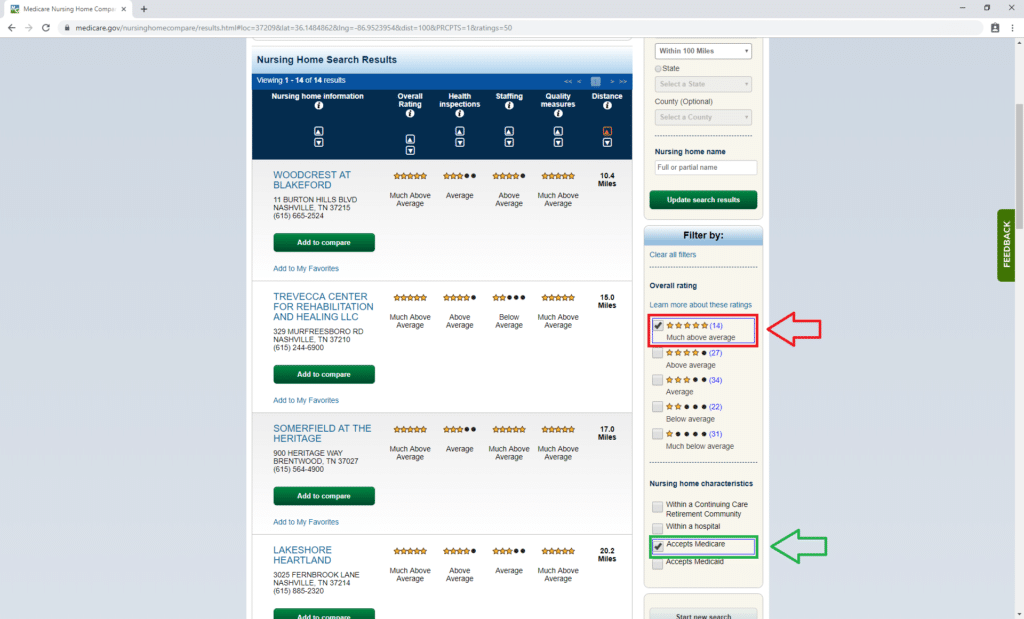

Then you’ll reach a list of nursing homes in your area. The nursing home finder tool lets you sort facilities by star rating, which is based on a scale of one to five.

Basically, the higher the rating, the better the care the facility provides. For demonstration purposes, we only chose to see homes that have a five-star rating (shown below in red) and that take Medicare insurance (in green.)

You may have to contact more than one facility to find the right one for you. Ask about costs and how they help patients with dementia. If one seems like it may be a good fit, ask to tour the home to really get a feel for it.

Resources for Families

Family members of dementia patients have access to a wide variety of resources to help them cope. The first step for helping your loved ones is to educate yourself about the disease and to learn how you can be the most supportive.

You should also look into support groups for your family so they can find like-minded people who are having similar experiences. Dementia should not be dealt with alone.

If you are a caregiver for a parent with dementia, you should consider important things such as who will have the power of attorney and make financial decisions for the patient at the end of his or her life. If you haven’t enrolled in a life or a final expense insurance policy, you should consider doing so now.

We Can Help You Find Medicare Coverage for Dementia

Dementia is difficult for everyone involved. If you or a loved one has dementia, we can help you navigate Medicare dementia care and find a Chronic Special Needs Plan that’s right for you. Set up a no-obligation appointment with a licensed agent by calling 844-431-1832 or contacting us here today.