Medicare SEP Changes 2020: When You Can Enroll If You’re Eligible for a DSNP or LIS

October 11, 2019DSNPs (Dual Special Needs Plans) are Medicare Advantage plans for people who are eligible for both Medicare and Medicaid. LIS (Low Income Subsidy), or Medicare Extra Help is a federal program that helps Medicare beneficiaries save money on prescription drugs.

If you are eligible for either DSNPs or LIS, your enrollment periods might be a bit different from others.

Am I Eligible for LIS?

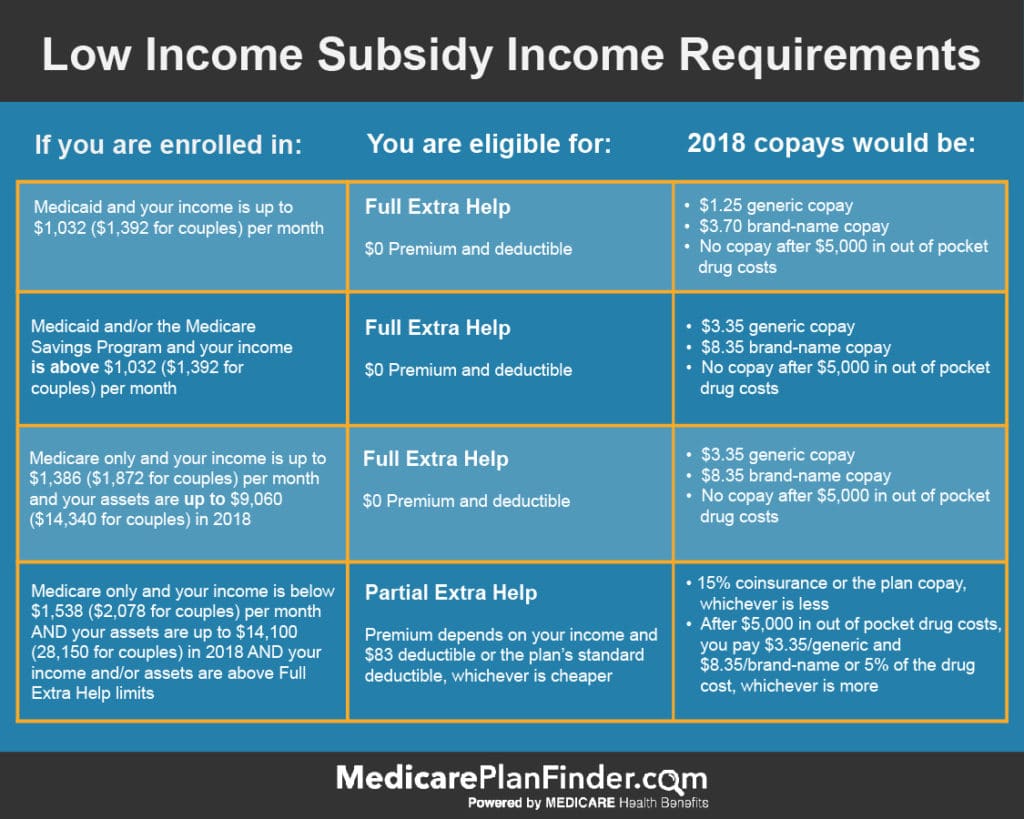

If you’re eligible for Medicare and you make less than 150 percent of the Federal Poverty Level, you may qualify for LIS. You can also automatically qualify for Extra Help if you’re already on SSI or you qualify for a DSNP.

What Does LIS Cover?

LIS helps qualifying people pay for prescription drugs and it covers items such as Part D premiums, deductibles, and the “Donut Hole”.

LIS coverage is offered on a sliding scale. That means the subsidy provides more or less help depending on your qualifications.

For example, if you’re single and you qualify for full LIS and Medicare only, you’ll pay no more than $3.40 for covered generic drugs and $8.50 for covered brand-name drugs. You will have no copay once you spend $5,000 out-of-pocket for covered prescription drugs.

What are Medicare DSNPs (Dual-Eligible Special Needs Plans)?

DSNPs cover your Original Medicare premiums and services, and, since they’re Medicare Advantage plans, they can offer additional benefits* such as:

- Prescription drugs

- Care coordination

- Hearing

- Dental

- Vision

- Non-emergency medical transportation

- Meal delivery

- Fitness classes

- Telehealth services

Many DSNPs have $0 monthly premiums, and if you see healthcare providers in your plan’s network, you shouldn’t have to pay Medicare deductibles and copays.

*Plan benefits and availability depend on many different factors such as location and carrier. Talk to your licensed agent to learn about available plans and covered services.

What Are the Changes to My SEP?

In the past, if you qualified for a lifelong SEP, you could enroll in a new DSNP, Medicare Advantage, or Part D plan up to once a month for the entire year.

In 2019 and 2020, if you’re eligible for a DSNP, LIS, or you only qualify for Medicare Savings Programs (MSPs) such as the Qualified Medicare Beneficiary (QMB) program or the Specified Low-Income Medicare Beneficiary (SLMB) program, the 2019-2020 CMS guidelines state that you can enroll in a new plan or drop coverage once per quarter for the first three quarters of the year (January – September).

Any changes you make during this time will become effective on the first of the month following the date you made the change. For example, if you enroll in a new DSNP plan on February 10, that change will become effective on March 1. You would not be able to make another change until the next quarter.

- Q1: January – March

- Q2: April – June

- Q3: July – September

- Q4: October – December

So, what does that mean for the rest of the year? Well, it means that you’ll fall into the AEP like everyone else.

The Annual Enrollment Period (AEP), which is October 15 to December 7, is a time when anyone can make changes to their existing Medicare coverage. Any AEP changes will take effect on January 1 of the following year. For example, if you make a change during AEP on November 15, that change will become effective on January 1.

Get the Medicare Health Insurance You Need Today

A licensed agent with Medicare Plan Finder may be able to help you find the coverage you need to stay in optimal health. Our agents are highly trained and they can find out what’s available in your area and help you make the right decision.

Our agents focus on the individual and offer an unbiased approach to helping you enroll in Medicare plans. To schedule a no-cost, no-obligation appointment, call 833-431-1832 or contact us here now.