What Can You Do During the Medicare Annual Enrollment Period?

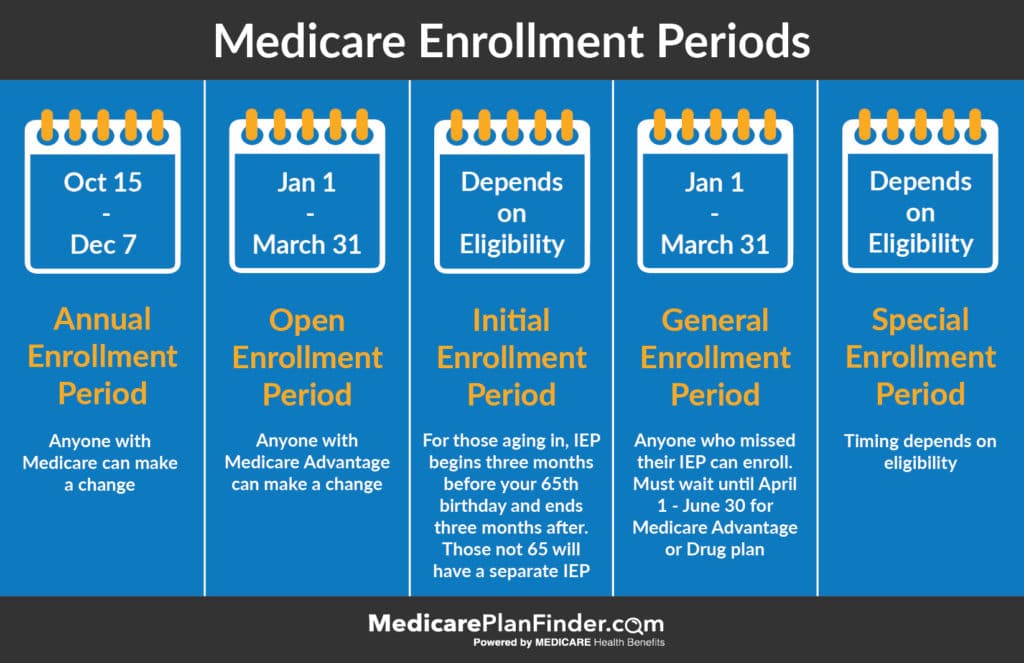

Did you know that there are five different Medicare enrollment periods throughout the year? Not everyone will be eligible for every period, but everyone who has Medicare is eligible for the Annual Enrollment Period.

Be sure to keep track of each enrollment period so that you know when it’s your turn to make changes. Don’t go months with a bad plan just because you missed your enrollment period!

What/When is the Annual Enrollment Period?

The Annual Enrollment Period runs from 10/15 through 12/7 of each year. This is the time when all Medicare beneficiaries are eligible to make changes, which will go into effect on January 1 of the following year. It does not apply to people who have not yet enrolled in any form of Medicare coverage. If you’re enrolling for the first time, you’ll have an “Initial Enrollment Period.” You can use the AEP later to make changes if you don’t like the choices you made during your IEP.

Changing Medicare Plans After the Annual Enrollment Period

There are a few other times throughout the year when you may be eligible to make changes.

The Initial Enrollment Period (IEP) is for those enrolling in Medicare for the first time. If you are aging into the program, this will begin three months before your 65th birthday and end three months after. If you become eligible due to disability, your IEP will depend on your disability status or diagnosis.

The General Enrollment Period (GEP) is for those who missed their IEP. It runs from January 1 through March 31. If you enroll during the GEP, your coverage will begin on July 1. You may face a late enrollment penalty fee for not enrolling during your IEP. If you want to enroll in Medicare Advantage during the OEP, you can do that between April 1 and June 30, or you can wait for the AEP.

The Special Enrollment Period (SEP) is not one specific time frame. You may qualify for a “temporary” SEP if you have a special circumstance that results in a loss of coverage, such as losing a job with coverage or moving to an area where different plans are available. You will likely have 30 days following the event to make a change. Some circumstances, like having a disability, can make you eligible for a different type of SEP. If you are disabled or have low-income and have a special needs plan, you can change plans once per quarter for the first three quarters of the year.

How can I get a SEP for Medicare?

To qualify to change plans once every quarter for the first three quarters of the year, you must:

- Be a member of a Medicare Savings Program or Medicaid

- Be part of SPAP (State Pharmaceutical Assistance Program)

- Be enrolled in a SNP (Special Needs Plan)

- Be in a Medicare Savings Program or LIS (Extra Help)

To qualify for to change plans once following an event, you must:

- Move to a new service area that has different plan options available

- Involuntarily lose your coverage

- Find a contract violation with your plan

- Lose or gain a job where you are enrolled in employer benefits

- Move into or out of a medical facility

- Leave imprisonment

- Suddenly gain or lose Medicaid eligibility

- Suddenly gain or lose Medicare Savings Program or LIS eligibility

- Have been automatically enrolled in Part D

OEP vs. AEP

OEP is not the same as AEP. During AEP, you can make a lot of different changes to your coverage. During OEP, you can only do one of the following:

- Switch from one Medicare Advantage plan to another

- Change from a Medicare Advantage plan with prescription drug coverage to Original Medicare + Part D

- Switch from Medicare Advantage to Original Medicare (can also add Part D)

What can I do During the AEP?

During AEP, you can make a number of different changes to your coverage, like:

- Enroll in a Medicare Advantage plan

- Switch to a different Medicare Advantage plan from what you had

- Drop your Medicare Advantage plan and have only Part A and Part B

- Add a Part D prescription drug plan

- Change to a Medicare Advantage plan with a prescription drug benefit

- Change from a MAPD (Medicare Advantage Prescription Drug Plan) to a Medicare Advantage plan without prescription coverage

- Change from one Part D plan to another

- Drop your prescription drug coverage and return to Original Medicare only

You can also add or remove Medicare Supplement (Medigap) coverage, but keep in mind that you can enroll in Medicare Supplements during any time of year. Enrollment periods to not apply to Medicare Supplement plans. However, if you enroll in Medigap any time past your Initial Enrollment Period, underwriting may apply, leaving you with higher costs than you could have had if you enrolled sooner.

Why the AEP is so Important for Medicare

The ability to make these changes every year is more important than you may realize.

Even if you think you’re happy with your plan, plans are allowed to change their benefits and costs every year. Your plan can add or remove benefits and make cost adjustments as they need to. At the same time, new plans are continually entering (and leaving) the market. It’s a good idea to take a look and see if there is a better plan for you each year.

Licensed agents are required to go through a training and certification process before they can sell to you. They are usually trained on what’s going on in the area that they sell in. They may be able to tell you about plans that you haven’t even heard about before, and they can help you sort through your options. It does not cost anything to meet with a Medicare Plan Finder licensed agent.

Can you Auto-Renew Medicare?

In most cases, you do not have to renew your plan each year. Your Medicare coverage will automatically continue as long as that plan is still available for the current year. The only reason your plan wouldn’t renew is if that specific plan itself leaves your service area or leaves Medicare.

However, that does not mean that you shouldn’t review your coverage each year. Have your finances or your healthcare needs changed? Has your plan changed its benefits or costs? Ask these questions every year to make sure you’re still getting the coverage you need.

How to Make Medicare Plan Changes

You can enroll in a new Medicare Advantage plan by getting help from a licensed agent. If you haven’t enrolled in Original Medicare yet, be sure to do that first by contacting Social Security either online or at 1-800-772-1213. You can also visit your local Social Security office.

To get in touch with a licensed agent in your area, click here or call us at (833)-567-3163.