Does Medicare Cover Weight Loss Programs [[mpf name="current_year"]?

December 3, 2019Did you know that you can use your Medicare coverage to fight obesity? Medicare coverage for weight loss can include obesity screenings, obesity counseling sessions, nutritionists, and qualified dietitians. It may even include gym membership discounts. If you think eating well and exercising is too expensive, think again: your Medicare plan can cover it!

Medicare Part B Weight Management Services

Since obesity is classified as a disease, Medicare Part B covers it like any other ailment. It all starts with your “Welcome to Medicare” annual wellness visit when you first enroll, and it continues with your yearly wellness visits. At your appointments, your doctor should check your height, weight, blood pressure, and BMI – all things that can help your doctor diagnose you with obesity and provide proper treatment. These appointments do not require cost-sharing.

If your doctor considers you at risk for obesity, you may be eligible for preventative counseling and even appointments with a nutritionist. Medicare Part B can cover medically necessary obesity counseling and nutrition therapy.

Obesity commonly leads to heart disease. Medicare Part B covers cardiac rehabilitation (exercise, education, and counseling) for those who have had a heart attack, heart failure, or a related surgery.

Nutritionists & Dietitians

Your doctor may recommend that you see a nutritionist or dietician.

Be careful when choosing a nutritionist or dietitian, because Medicare does not cover all of them. For Part B to cover this service, you must medically require it, and the nutritionist or dietitian must accept Medicare assignment. Medicare only covers trained nutritionists under Part B as MNT (medical nutrition therapy). Any patient who has diabetes, kidney disease, or has had a kidney transplant is eligible based on medical need.

Obesity Screenings & Counseling

As long as you have Medicare Part B and have a BMI (body mass index) of 30 or higher, you are eligible for obesity screenings and counseling. The National Heart, Lung, and Blood Institute has a free BMI calculator on its website, but a doctor’s screening will be much more accurate. Your BMI is the percentage of your bodyweight that is made up of fat. Remember that some fat is healthy – you are not aiming for a BMI of zero. A healthy BMI is between 18 and 25. Lower than 18 is too little, 25-30 is a bit high, and above 30 is obese.

When you do get your free obesity screening, you might consider behavioral counseling for body fat loss. Your primary physician should offer their own obesity counseling. If not, they might recommend another Medicare-covered service.

Gym Memberships

The only true “Medicare weight loss programs” are fitness programs.

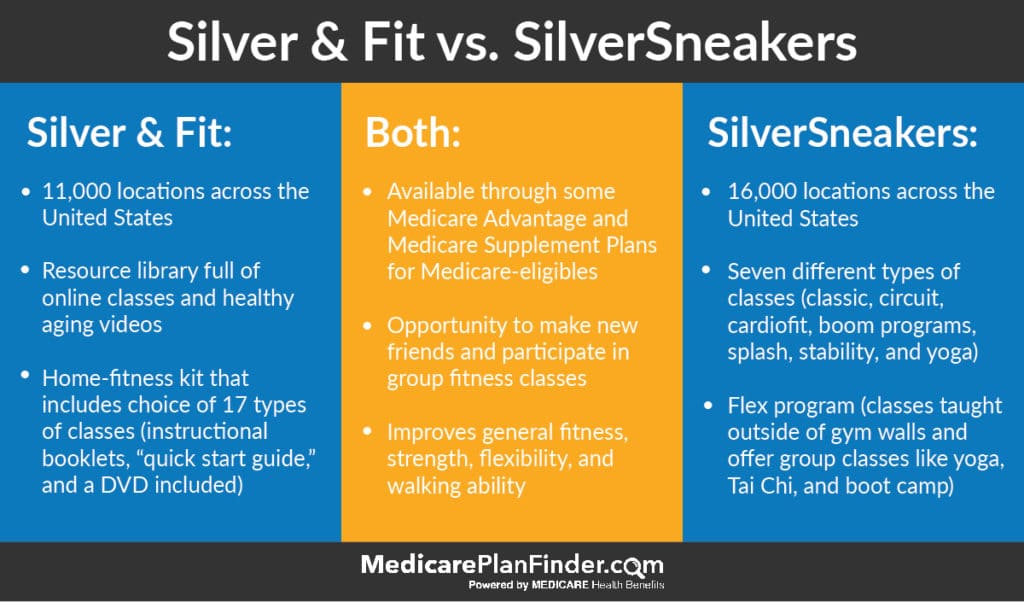

Original Medicare (Part A and Part B) does not cover gym memberships or fitness programs, but private plans may include a gym membership or fitness center discounts. These are usually offered through major Medicare fitness programs such as SilverSneakers® and Silver & Fit®.

Plans with these benefits are not available in every county. Look over your plan or speak with your agent if you aren’t sure about fitness coverage in your Medicare plan.

Obesity Is a Disease

In 2013, the American Medical Association officially started recognizing obesity as a disease. As such, with a BMI of 30 or higher, you can qualify for “obesity behavioral therapy.

The disease affects approximately ⅓ of Americans, and this recognition allows it to be taken more seriously in the medical community and increase research funding. The classification also helps decrease the stigma involved with obesity. It is a commonplace lie that obesity is merely the result of overeating and a lack of exercise. Some people lack the mental strength to control their eating habits and others are incapable of exercising for one reason or another. Saying that obesity is a disease opens the door for obesity counseling and physical therapy as a form of treatment.

Obesity is a common disease in the senior citizen community due to a reduction in physical activity and a lack of access to good nutrition. Additionally, other common senior conditions like heart disease, diabetes, and physical impairments can make it harder to focus on nutrition and exercise. That’s why it’s so important to use your Medicare coverage for healthy eating, exercise, and weight loss.

Does Medicare Cover Weight Loss Surgery/Bariatric Surgery?

Medicare Part B covers bariatric surgeries such as gastric bypass surgery and laparoscopic banding surgery (LAP-BAND). However, you must meet certain criteria. For example, your doctor must determine that Medicare weight-loss surgery is necessary.

Bariatric surgery is a procedure that reduces the amount of food the stomach can hold, effectively forcing you to eat less. However, it is invasive and not recommended for everyone.

Medicare does NOT cover cosmetic surgeries, such as excess skin removal for weight loss surgery.

Types of Bariatric/Weight-Loss Surgeries

The most common bariatric surgeries are a gastric bypass, a sleeve gastrectomy, an adjustable gastric band, and a biliopancreatic diversion with duodenal switch.

Generally, bariatric surgery is recommended for people with:

- A BMI between 35 and 39.9

- A health condition such as:

- Type 2 diabetes

- Sleep apnea

- High blood pressure

- Osteoarthritis

- A history of failed medically-supervised dieting

Gastric Bypass

A gastric bypass is a weight-loss surgery that has been performed for over 50 years, making it the most experienced bariatric operation. In this procedure, a large section of the stomach is stapled off, creating a pouch that connects to the small intestine. The pouch can only hold a few ounces of food, so patients are unable to eat as much as they used to (and won’t feel as hungry).

This procedure requires that patients make major dietary changes. Protein, vitamin B12, iron, and calcium become increasingly important. Sweet and fatty foods must be avoided.

Sleeve Gastrectomy

A sleeve gastrectomy is performed laparoscopically. About 75% of the stomach is removed, causing it to form a “sleeve” shape. This procedure is used for people with a BMI over 40. It often results in 60% weight loss.

A sleeve gastrectomy cannot be reversed. It typically does not have an effect on diet (except for during recovery time).

Adjustable Gastric Band

A laparoscopic gastric banding procedure is the least invasive. A soft, silicone ring with an expandable balloon is implanted at the top of the stomach. It basically creates two compartments for the stomach. The patient will only eat enough food to fill the top part. Over time, the food will pass through into the second (original) compartment of the stomach and will be digested.

This surgery is newer and was not approved until 2001. There may be some long-term complications with this surgery, such as frequent vomiting, implant malposition, erosion, or weight loss failure.

Biliopancreatic Diversion with Duodenal Switch

The duodenal switch procedure starts with a sleeve gastrectomy. Then, the lower intestine is divided, leaving only a few feet of intestine connected to the digestive tract.

This procedure usually results in the greatest weight loss, but patients will likely have frequent and loose bowel movements and gas. Patients will also need to be closely monitored for healthy vitamin, mineral, and protein levels.

In some cases, a doctor or surgeon may recommend that you undergo the sleeve gastrectomy first, then revisit the duodenal switch in 9-12 months.

The duodenal switch often results in 60-80 percent excess weight loss within two years.

Finding a Doctor for Obesity Treatment

Your primary physician can at least help you get started on your obesity treatment but might refer you to a nutritionist or other specialist if necessary.

Be sure to check with your plan network to make sure your doctors and specialists are covered. You can use Medicare.gov’s Physician Finder to find out if a doctor accepts Medicare, and visit your private plan’s website to find out if your doctor or specialist is in your plan’s network.

Are There any Medicare-approved Weight Loss Programs?

Medicare has not formally approved any weight loss programs or fad diets. Speak to your doctor before joining a new program. Here is some information about popular weight loss programs.

Recently, private Medicare Advantage plans have been given the ability to cover more benefits, and dietary programs like this could be one of them. However, it is more common to find Medicare Advantage plans that cover Medicare fitness programs and nutritionists.

Optifast

Optifast is advertised as a “medically-supervised” and “science-based program that delivers weight loss for health gains.” On average, Optifast users ave lost 30 pounds over 26 weeks (which is a healthy ratio). They’ve also seen decreases in blood glucose levels, blood pressure, and cholesterol.

The program provides meal replacements that include 100% of the recommended daily value of 24 different vitamins and minerals. There are five daily servings. Optifast comes in shake mix, bars, soups, and chewable vitamins.

Jenny Craig

The Jenny Craig plan includes a variety of foods and a personal consultant that you can connect with weekly. The meal plans ask you to eat every two to three hours and allow you to mix in your own fresh fruits, vegetables, and dairy. Three entrees and two snacks cost less than $25 per day.

In some areas, you’ll be able to visit and pick up your food from a local weight loss center. Otherwise, you can join Jenny Craig online.

Weight Watchers

Weight Watchers revolutionized fad dieting with their point system.

Each Weight Watchers user will have a unique amount of “points” they are able to use each day. Every piece of food is awarded a point value (though some may be worth 0 points). Your daily point budget is based on your age, height, weight, and sex. Technically, you can eat whatever you want as long as you don’t go above your daily points budget.

Weight Watchers is not very expensive, starting at $3.07 per week for the digital-only plan. You can download the Weight Watchers app and do it all yourself!

What’s nice about the Weight Watchers diet is that you don’t have to eat frozen foods shipped to you, you can keep buying your own groceries and cooking healthy meals. You may even be able to keep enjoying some of your favorite foods, as long as you enjoy them in moderation.

Medicare for Diabetes and Weight Loss

Obesity can put you at a higher risk of developing diabetes. You can use your Medicare coverage to help prevent both obesity AND diabetes.

Medicare Part B covers diabetes self-management training (DSMT), blood sugar monitors, blood test strips, lancets devices, lancets, therapeutic shoes or inserts, and external insulin pumps.*

Additionally, Medicare can cover your participation in the 16-session Diabetes Prevention Program if you:

- Have a BMI over 25 (23 if you are Asian)

- Have never been diagnosed with either diabetes or ESRD

- Have not participated in this program before

- Have a hemoglobin A1c test result of 5.7-6.4%, a fasting plasma glucose result of 110-125 mg/dL, or a two-hour plasma glucose result of 140-199 mg/dL (test results must be from the past 12 months)

Click here for a full guide on Medicare diabetes coverage.

*There may be some coverage limitations.

What Else Does Medicare Cover, and Do I Qualify?

Medicare Part A covers hospital stays, and Medicare Part B covers physician services. If you are over the age of 65, you automatically qualify for Medicare coverage. You can also qualify by receiving SSDI (Social Security Disability Income) for 25 months or more or by being diagnosed with either ALS (Lou Gehrig’s Disease) or ESRD. Most people will get premium-free Part A but will have to pay a monthly premium for Part B.

To add more to your Medicare plan, the best option is to enroll in a MAPD, or Medicare Advantage Prescription Drug plan. These plans include everything that Part A and Part B covers plus prescription drug coverage and other benefits like dental, vision, and fitness programs like SilverSneakers® and Silver & Fit®.

We have benefits advisors in 50 states that can help you select the best Medicare Advantage Prescription Drug plan for your needs.

Some people may even be able to get a MAPD plan with a $0 premium! To find out more, chat with us, send us a message, or give us a call at (833)-567-3163.

This post was originally posted on June 22, 2017, and was last updated on December 3, 2019.