How does Medicare work?

Currently, about 44 million people are enrolled in Medicare. As Americans continue to age at a rising rate and Baby Boomers enter their golden years, that is expected to rise to 79 million by 2030, making Medicare more critical than ever.

Medicare provides an essential health care safety net, so you must have a good understanding of how the program works, whether you’re accessing benefits soon or in the future. Here’s what you need to know.

How Medicare Works

Medicare is a federally sponsored healthcare plan for seniors 65 and older and for other people younger than 65 who meet specific qualifying criteria.

It is divided into four parts.

Part A and Part B are often referred to as Original Medicare. These two parts cover hospital and hospital-related medical expenses, outpatient care services, durable medical equipment, some prescriptions, ambulance services, testing, and much more.

Part C is known as Medicare Advantage and is a form of private insurance offered by private insurance companies that must, at a minimum provide the same levels of benefits as Original Medicare. Some Part C plans to provide more. Policies coverage and costs will vary, but frequently, coverage will exceed what’s covered under Part A and B.

Private companies offering these plans are paid by Medicare and incentivized to keep their patients healthy; that is why they often offer benefits not available under original Medicare.

Part D is also an optional insurance program that offers enhanced prescription drug coverage. If you’re eligible for Part A and B coverage, you can also purchase a Part D plan from a company or private insurer that has been approved by Medicare.

In some cases, prescription drug coverage is covered under a Part C plan. Even though Part D is optional, there are scenarios where penalities can occur.

Medicare supplement policies, known as Medigap, are also available. These policies bridge the “gap” between what Original Medicare covers and the actual costs for services or pays for services not covered by Part A or Part B.

For example, if Original Medicare covers 80%, the additional 20% can be covered through the use of supplemental insurance or Medigap insurance.

How Original Medicare Part A Works

Medicare Part A and Medicare Part B, when combined, are known as Original Medicare.

Part A covers many hospital and hospital-related medical expenses, including:

- Hospital stays

- Inpatient skilled nursing facility care (but not custodial or long-term care)

- Home health services

- Hospice care (in some cases)

If a doctor has certified you as having a terminal illness with an estimated six months or less to live, you could be eligible for hospice care. The focus of this care is to relieve pain and make a patient as comfortable as possible.

To be covered, you must agree to give up treatments to cure your terminal illness.

You may need to meet a deductible before Medicare kicks in. You may also have to pay a copayment for services and supplies.

Most of the time, you won’t need to file a claim because the law requires providers to file claims on your behalf.

How Original Medicare Part B Works

While Part A covers a wide range of hospital-related costs, Part B covers a bundle of services generally related to outpatient care.

That includes services and supplies that are considered medically necessary to treat a condition or a disease. Some of those things include:

- Doctor visits

- Lab tests

- X-rays

- Ambulance services

- Surgeries in a hospital or doctor’s office

- Durable medical equipment (DME) such as wheelchairs, walkers, casts, body braces, pacemakers, hospital beds, and more

- Health screenings for cancer, diabetes, heart disease, and others

- Mental health services

- Physical and speech therapy

- Some outpatient prescription drugs

- Flu shots

- Mammograms/PAP smears

If you qualify for your Medicare Part A premiums to be covered at no cost, then you’re also eligible for Part B if you enroll and pay a monthly premium. The standard premium for 2020 is $144.60, but you may pay more or less depending on your circumstances.

For example, if you make more than $87,000 a year, your Part B premium will be adjusted based on your income.

If you don’t qualify for Part A coverage, you can still get Part B coverage if you’re 65 or older, and you’re a U.S. citizen or a permanent resident who has lived in the United States for five years before applying for Part B benefits.

Also, you can have both Medicare and Veterans Affairs benefits, but benefits do not overlap. Medicare will not pay for any services rendered at a VA facility.

And, for the VA to cover your care, you must receive services at a VA facility. If you have the option, experts generally agree it’s best to enroll in both if you can.

How Medicare Part C Works (Medicare Advantage)

Medicare Part C is commonly referred to as Medicare Advantage and is an optional plan offered by a private insurer. By law, a Part C policy is required to provide the same level of benefits as Original Medicare, but it will also offer additional benefits for greater coverage.

Some of these benefits might include vision, dental, or prescription drug coverage.

To enroll in a Medicare Advantage plan, you must already be enrolled in Part A and Part B. Even after Part C coverage starts, you must still pay Part B premiums. There is a common myth that Part C removes your Part A and Part B, which is completely false.

You are NOT eligible for Part C unless your Parts A and B are active.

If you enroll in a Medicare Advantage Plan, it may have different rules and policies, but the plan must give at least the same coverage level as Original Medicare.

Policy costs and specific coverages will vary by provider. Medicare allows for some flexibility so that some beneficiaries may pay more each month for a smaller deductible or a lesser amount for copayments.

One of the big differences between a Medicare Advantage plan and Original Medicare is that Advantage plans have maximum out-of-pocket amounts for each year. Original Medicare does not.

That means once your maximum amount is reached, there will be no charges for covered services.

How Medicare Part D Works (Prescription Drug Coverage)

Medicare Part D specifically covers prescription drug plans. If you’re eligible for Part A and Part B coverage, you can purchase a Part D plan.

Just like Part C plans, Part D plans are also offered by private insurers. Costs and coverages will vary by policy and by the provider.

Only providers that have been approved by Medicare can provide beneficiaries with Part D policies.

In some cases, a separate Part D policy may not be necessary because prescription drug coverage will already be covered under a Part C policy.

Depending on the policy you buy, you may be restricted to buying less expensive generic drugs, or you may be limited in the quantity you can buy. In some cases, you’ll also need to obtain prior authorization.

This is why it’s incredibly important that you take the time to review your drug benefits every year.

Costs can vary widely for a Part D policy due to yearly deductibles, the number of copayments required, and whether or not there is a coverage gap.

Medicare offers an Extra Help Program to assist low income and limited resource beneficiaries pay for Part D expenses.

Part D plan benefits are also subject to coverage tiers, which can result in a coverage gap, which is also known as the Donut Hole. After you have spent a certain amount of money for covered drugs in a year, you’ll have to pay all costs out of your own pockets up to a yearly limit.

Once you reach your annual limit, the Donut Hole ends, and your drug plan will help pay for covered drugs again.

The donut hole has been improved over the last few years but can still have financial impacts on you.

The Medigap Option (Medicare supplement insurance)

Medigap policies are additional health insurance you buy to pay for health costs not covered by Original Medicare. That can include deductibles, copayments, and coverage if you travel outside the United States.

For example, Medicare Part B covers 80% of costs after you meet the deductible. A Medigap plan can help cover the remaining 20%, altering the cost-sharing you might be facing.

Medigap policies won’t cover dental, vision, private-duty nursing, long-term care, or prescription drugs in most cases.

You can only purchase a Medigap policy if you already have Part A and Part B coverage. You can’t buy a Medigap plan if you have an active Medicare Advantage plan.

Also, Medigap policies are written for only one person at a time. If you and your spouse want Medigap coverage, you’ll need to buy separate policies. However, many companies will provide you with a spousal discount on your premiums.

Medigap plans are labeled A through N, and each lettered policy group offers a different level of health coverage. Premiums vary by company, but if you buy a Medigap Plan G policy from one company, the benefits will also be the same as if you bought a Plan G policy through another company.

Costs will vary depending on the level of coverage and services offered. Cheaper plans will cover fewer services and have higher out-of-pocket costs. More expensive plans will afford you a higher level of protection.

There are a few exceptions to this. Standard Medigap policies are different if you buy one in Minnesota, Massachusetts, or Wisconsin.

Open enrollment for Medigap plans is six months from the first day of the month that you turned 65 as long as you are also signed up for Medicare Part B. If you buy a policy during this window, you can buy a Medigap policy at the same price a person in good health would pay.

Outside of this window, there’s no guarantee you will be offered coverage, or if you are covered, it may be at a higher premium.

The catch is that you may be required to wait up to six months for coverage if you have a pre-existing condition. The insurer can refuse to pay your out-of-pocket expenses during this time, but at the end of six months, they must cover your pre-existing condition.

A standardized Medigap policy is guaranteed renewable if you pay your premiums on time. That applies even if you have health issues.

How does Medicare work with other insurance?

If you have more than one health insurance policy, there needs to be a coordination of benefits to determine which one is the primary payer and which one is the secondary payer.

The primary payer will pay up to the limits of its coverage first. The secondary payer will only pay if there are costs not covered by the primary payer.

Just because there are multiple payers, it does not automatically mean that the secondary payer will pay all of the remaining uncovered costs.

If you have multiple coverages, you need to let your healthcare provider know in advance that this is the case so that they can send your bills to the correct provider. That will avoid delays in payment processing.

Prior to 1980, Medicare was the primary payer for most claims (the exceptions were claims covered by Workers’ Compensation, Federal Black Lung benefits, and Veteran’s Administration benefits). Congress passed legislation that made Medicare the secondary payer for some primary plans as a means of shifting costs from Medicare to other private sources of payment.

To better understand some common situations where Medicare will be the primary or the secondary payer, go here.

All states offer Medicaid programs, and the eligibility and coverages vary from state to state. In some cases, Medicare will be the primary payer, and in other cases, Medicaid will be the primary provider. If you’re dual eligible and not sure how payments will work, you can call 1-800-MEDICARE or contact your local Medicaid office to get answers to your questions.

If you have questions about which provider pays first, or if your coverage changes, call Medicare’s Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627) to help you determine how your coverages will work together.

You can also call your former employer’s HR department to get clarification about your situation.

Medicare Coverage if You’re Disabled

If you’re disabled and you have been approved for Social Security disability insurance (SSDI), then you are eligible to receive Medicare. However, there is a two-year waiting period for SSDI recipients before they’re eligible for Medicare benefits.

Similarly, if you are approved for Supplemental Security Income (SSI), you will receive Medicaid benefits. There is no waiting period if you get SSI benefits before you are eligible for Medicaid benefits.

The exact processes vary from state to state, but in most instances, when you’re approved for SSI, you’re automatically approved for Medicaid.

You can get Medicare benefits if you get SSI, but you’ll have to wait until you turn 65. At 65, you can file an uninsured Medicare claim.

States pay the medical premiums for the uninsured person to be in Medicare so that medical costs can be passed along to the Federal government, saving the state’s costs to provide Medicaid coverage.

In some cases, disability recipients are dual-eligible, meaning they draw money from both SSDI and SSI. How benefits work in concert with each other is a bit murky. It’s best to contact a local Social Security office to understand how Medicare and Medicaid will work together fully.

Medicare Eligibility

You are eligible for Medicare if you meet the following requirements:

- You are age 65 or older, a U.S. citizen, or a permanent legal resident of the U.S., and you have lived in the country for at least five years in a row.

- You are currently getting retirement benefits from your Social Security or retirement benefits from the Railroad Retirement Board.

- You are disabled, and you are receiving SSDI benefits or Railroad Retirement disability benefits (there is a two-year waiting period from when you first start receiving disability benefits).

- You, or your spouse, previously worked in a job that had Medicare-covered government employment.

- You have end-stage renal disease (ESRD), and you require dialysis or a transplant.

- You have amyotrophic lateral sclerosis (Lou Gehrig’s disease or ALS).

If you or your spouse didn’t pay Medicare taxes while you worked, you might still be eligible for Part A if you pay a monthly premium. Most beneficiaries do not pay a premium for Part A if they worked at least 10 years (40 quarters) and paid Medicare taxes during that period.

How to enroll in Medicare

For general information on Medicare and the enrollment process, visit the Medicare website.

Part A and Part B

If you’re over 65 or you’re turning 65 within the next three months, you can enroll in Part A and/or Part B online through Social Security.

You can also call Social Security at 1-800-772-1213 (TTY users 1-800-325-0778), Monday through Friday, from 7 am to 7 pm.

If you prefer, apply in person at your local Social Security office.

If you worked at a railroad, you can enroll by calling the Railroad Retirement Board at 1-877-772-5772 (TTY users 1-312-751-4701). Assistance is available Monday through Friday, from 9 am to 3:30 pm.

Part C and Part D

You will need to shop around for a plan that works best for your needs. You can either do the work yourself or work with an expert agent who will help guide you to your situation’s best decisions.

You’ll need several documents and information when you enroll. Here’s a handy checklist to give you an idea of what those documents are.

When you enroll, you’ll need to have several pieces of information and documents to complete the process. Among these is a certified copy of your birth certificate or another form of proof of birth, proof of US citizenship or legal residency, your Social Security information, existing health insurance information, and copies of your tax return or self-employment information.

If you’re still working

Medicare eligibility begins at age 65, but there are different rules in place if you’re still working. You can avoid a premium surcharge if you delay enrolling as long as you’re still working, you have coverage under an employer group plan, and the employer has 20 or more employees.

However, because Medicare Part A is free, it often makes sense to enroll in Part A anyway. This allows Medicare to serve as your secondary insurance and pay for anything your current group insurance does not cover.

What are the Medicare enrollment periods?

Initial Enrollment Period

Under most circumstances, you’ll first be able to enroll in Medicare during a seven-month window wrapped around your birthday. That includes three months before your birthday, your birthday month, and three months afterward.

Strongly consider enrolling during this timeframe. If you don’t, you could wind up paying a premium penalty if you enroll later on.

If you’re receiving Social Security benefits at age 65, then you’re automatically enrolled in Parts A and B. Otherwise, you’ll have to initiate the enrollment process on your own.

Annual Enrollment Period

Each year between October 15 and December 7, you can switch plans, drop or join coverages or keep the same coverages but switch to a new insurer. This is the time of year when plan benefit changes are announced, allowing Medicare beneficiaries to ensure they are electing the plan that still best fits their needs.

Any changes made during this period go into effect on January 1 of the following year. Every September, beneficiaries receive an Annual Notice of Change letter that will detail what changes will affect your plan in the coming year.

General Enrollment Period

If you didn’t sign up for Part A and B coverage when you were first eligible, you can sign up for Part A and Part B coverage between January 1 and March 31 of each year. The coverage will begin on July 1.

The catch is that if you sign up during this period instead of your Initial Enrollment Period, you could face late enrollment penalties.

Medicare Open Enrollment Period

From January 1 to March 31 each year, beneficiaries enrolled in a Medicare Advantage or Part D plan can make a one-time election to switch to another plan or drop their Part C or D coverage and go back to Original Medicare. Many people choose to do this if their doctor is leaving a network or the network becomes more restrictive.

Special Enrollment Period

When you lose your current coverage, qualify for a low-income subsidy, or you move out of an area, and your current Medicare plan no longer covers you, you can qualify for a Special Enrollment Period. That gives you two months to sign up for a new plan. Your new coverage will begin the first day of the month after you sign up.

Medicare Costs

There is no easy or straightforward answer to the question, “How much does Medicare cost?”

Here are some general guidelines, but be aware that your situation will probably vary in some manner.

Most people don’t have to pay a premium for Part A when they meet eligibility requirements. If you have to buy Part A, you could pay as much as $458 monthly in 2020 if you paid Medicare taxes for less than 30 quarters.

If you paid Medicare taxes for 30-39 quarters, your monthly premium would be $252.

You will have to meet a $1408 deductible for Part A for each benefit period.

The standard Part B premium is $144.60 per month in 2020. It could be higher than this, depending on your income.

The Part B deductible is $198. After this, most of the time, you’ll pay 20% of the Medicare-approved amount for most doctor services. If you get Social Security or Railroad Board benefits, your Part B premium will be automatically deducted from your benefit payment.

If you don’t get benefits, you’ll be billed for Part B coverage (once every three months). You’ll also be billed for Part A if you are required to pay for it (billed every month).

Part C premiums vary by plan. You’ll need to shop and compare prices, benefits, and other factors to determine how much you’ll pay each month.

Part D premiums also vary by plan. Sometimes, Part D coverage is rolled into a Part C plan, meaning you’ll have no costs. In other instances, if you have a higher income, you may need to pay more for coverage.

You can pay your Medicare bill several ways:

- Online with a credit or debit card

- Directly through your bank’s online bill payment services

- Through Medicare Easy Pay, a free service that automatically deducts premiums from your bank accounts

- Mailing your payments to Medicare

Medicare will send reminders if your payments are late. But ultimately, if you don’t make payments in a reasonably timely manner, you’ll lose your Medicare coverage.

Getting help with Medicare costs

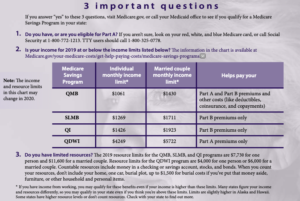

If you’re having trouble making your Medicare premium payments, there are several possible avenues of assistance. Your state may be able to help you by accessing Medicare Savings Programs.

There are four kinds of Medicare Savings Programs:

Qualified Medicare Beneficiary (QMB)

Specified Low-Income Medicare Beneficiary (SLMB)

Qualified Disabled & Working Individuals (QDWI)

If you qualify for a QMB, SLMB, or QI program, you automatically qualify for Extra Help paying for Medicare prescription drug coverage.

If you think you qualify for assistance, visit the Medicare website for more information, or:

Call 1-800-MEDICARE (1-800-633-4227). TTY users call 1-877-486-2048.

Call your local Medicaid office or go online to the State Health Insurance Assistance Programs website. It provides free insurance counseling and assistance to Medicare beneficiaries, their families, friends, and caregivers.

Important Factors to Consider When Choosing a Medicare Plan

Making the right choices when it comes to Medicare coverage involves several factors. Here are several things to consider:

- Costs – Be clear on what your premiums, deductibles, copays, and other costs will be when buying a plan. Also, determine if there is a limit on out-of-pocket expenses. A Medicare Advantage plan can provide substantial added benefits when coupled with Part A and Part B coverage.

- Coverage – Understand which part of Medicare covers you and to what extent. If you need additional coverage through a Medicare Advantage plan, make sure the coverage you need is what the policy provides.

- Your other coverage – Understand how multiple plans work together. Have a clear understanding of who the primary and secondary payers are to avoid billing issues that could cost you money down the road.

- Prescription drugs – A private insurer offers each prescription drug plan, so deductibles, copays, and premiums will vary. Each plan also has a list of drugs that it covers. This is called a formulary. You need to check the formulary to make sure the medications you need are covered and included.

- Doctor and hospital choices – Different plans have different providers for both doctors and hospitals. If you feel strongly about certain providers, make sure they’re in the network you choose.

- Quality of Care – The Centers for Medicare & Medicaid Services rates each plan’s quality and performance and assigned a star rating to help people shop for a plan. Also, do your homework to see what kind of ratings and reviews a particular plan has.

- Travel – Will your coverage travel with you if you frequently visit or live in another place for at least part of the year? With Original Medicare, you can visit any doctor or facility in the United States that accepts Medicare. Medicare Advantage plans require you to stay in-network to save money unless you have a life-threatening injury or condition.

Revised on November 3, 2020.